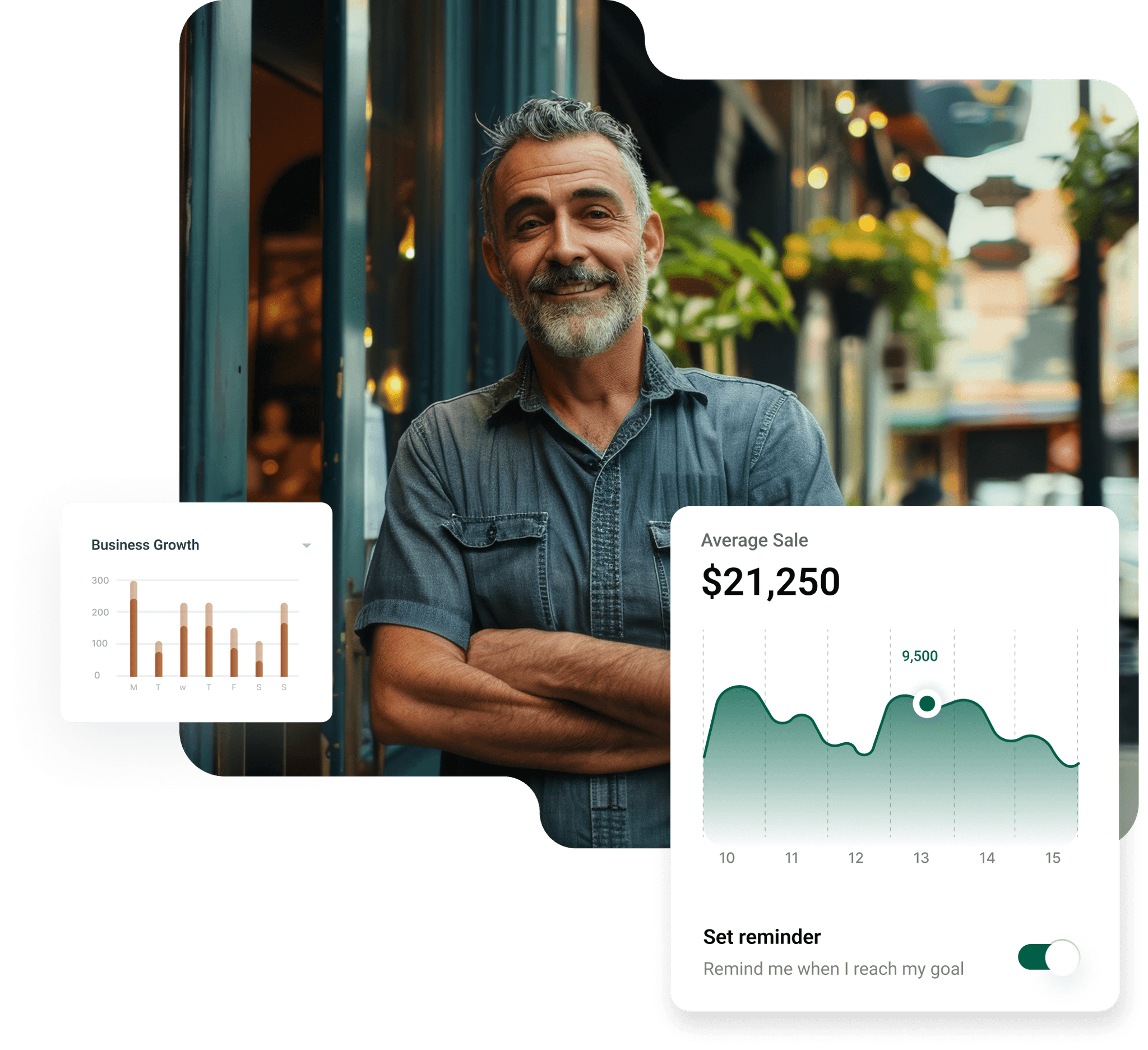

Your one-stop shop for accounting

Copper provides full-service bookkeeping, tax, and advisory services to small and medium sized businesses

Trusted by Business Owners

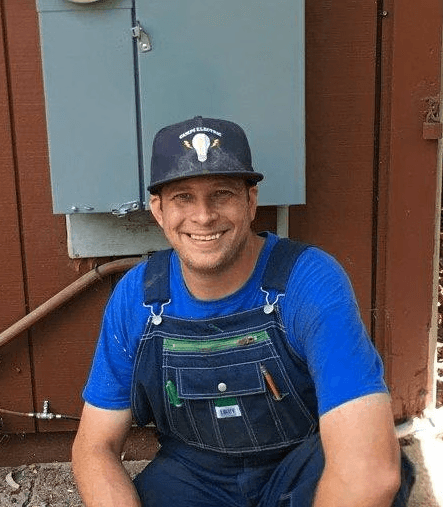

Their monthly financial statements have been incredibly helpful for my business planning. I didn’t know how important my balance sheet was and found out that I had been missing out on depreciation and interest expenses.

Rishi Jethi

Owner - Illumeably Media

Their monthly financial statements have been incredibly helpful for my business planning. I didn’t know how important my balance sheet was and found out that I had been missing out on depreciation and interest expenses.

Rishi Jethi

Owner - Illumeably Media

Their monthly financial statements have been incredibly helpful for my business planning. I didn’t know how important my balance sheet was and found out that I had been missing out on depreciation and interest expenses.

Rishi Jethi

Owner - Illumeably Media

What Sets Copper Apart

Grow your business with an expert accounting partner in your corner

Level of Service

Fast communication, regular updates, and hands-on guidance

Fast communication, regular updates, and hands-on guidance

Quality of Work

100% accuracy in your books or your money back

100% accuracy in your books or your money back

Business Insights

Get regular financial reports and make informed decisions

Get regular financial reports and make informed decisions

Our Services

Our dedicated team of professionals meticulously manage your books

and other accounting needs

Full Service Bookkeeping

Get accurate books, financial insights, and smooth accounting operations

Tax Services

Save on your annual tax bill with expert tax advisory, planning, and filing

Save on your annual tax bill with expert tax advisory, planning, and filing

Save on your annual tax bill with expert tax advisory, planning, and filing

Who We Help

Frequently Asked Questions

Still have any questions? Contact our team at nick@copperaccounting.com

01

What accounting software do you work with?

Currently we are only taking on clients that use QuickBooks Online. However, if you're using a system that integrates with QuickBooks Online we may still be able to help you out.

02

Where are you based?

03

Can I outsource all of my accounting to you?

04

What if I already have a CPA?

05

How much do your services cost?

06

What does your pricing structure look like?

Frequently Asked Questions

Still have any questions? Contact our team at nick@copperaccounting.com

01

What accounting software do you work with?

Currently we are only taking on clients that use QuickBooks Online. However, if you're using a system that integrates with QuickBooks Online we may still be able to help you out.

02

Where are you based?

03

Can I outsource all of my accounting to you?

04

What if I already have a CPA?

05

How much do your services cost?

06

What does your pricing structure look like?

Frequently Asked Questions

Still have any questions? Contact our team at nick@copperaccounting.com

01

What accounting software do you work with?

Currently we are only taking on clients that use QuickBooks Online. However, if you're using a system that integrates with QuickBooks Online we may still be able to help you out.

02

Where are you based?

03

Can I outsource all of my accounting to you?

04

What if I already have a CPA?

05

How much do your services cost?

06

What does your pricing structure look like?

Frequently Asked Questions

Still have any questions? Contact our team at nick@copperaccounting.com

01

What accounting software do you work with?

Currently we are only taking on clients that use QuickBooks Online. However, if you're using a system that integrates with QuickBooks Online we may still be able to help you out.

02

Where are you based?

03

Can I outsource all of my accounting to you?

04

What if I already have a CPA?

05

How much do your services cost?

06

What does your pricing structure look like?

One place for all of your accounting needs

We'll take over your accounting operations, ensure your financial health, and help you grow

Quick Links

© 2025 Copper Accounting

One place for all of your accounting needs

We'll take over your accounting operations, ensure your financial health, and help you grow

Quick Links

© 2025 Copper Accounting

One place for all of your accounting needs

We'll take over your accounting operations, ensure your financial health, and help you grow

Quick Links

© 2025 Copper Accounting

One place for all of your accounting needs

We'll take over your accounting operations, ensure your financial health, and help you grow

Quick Links

© 2025 Copper Accounting